October - December 2021

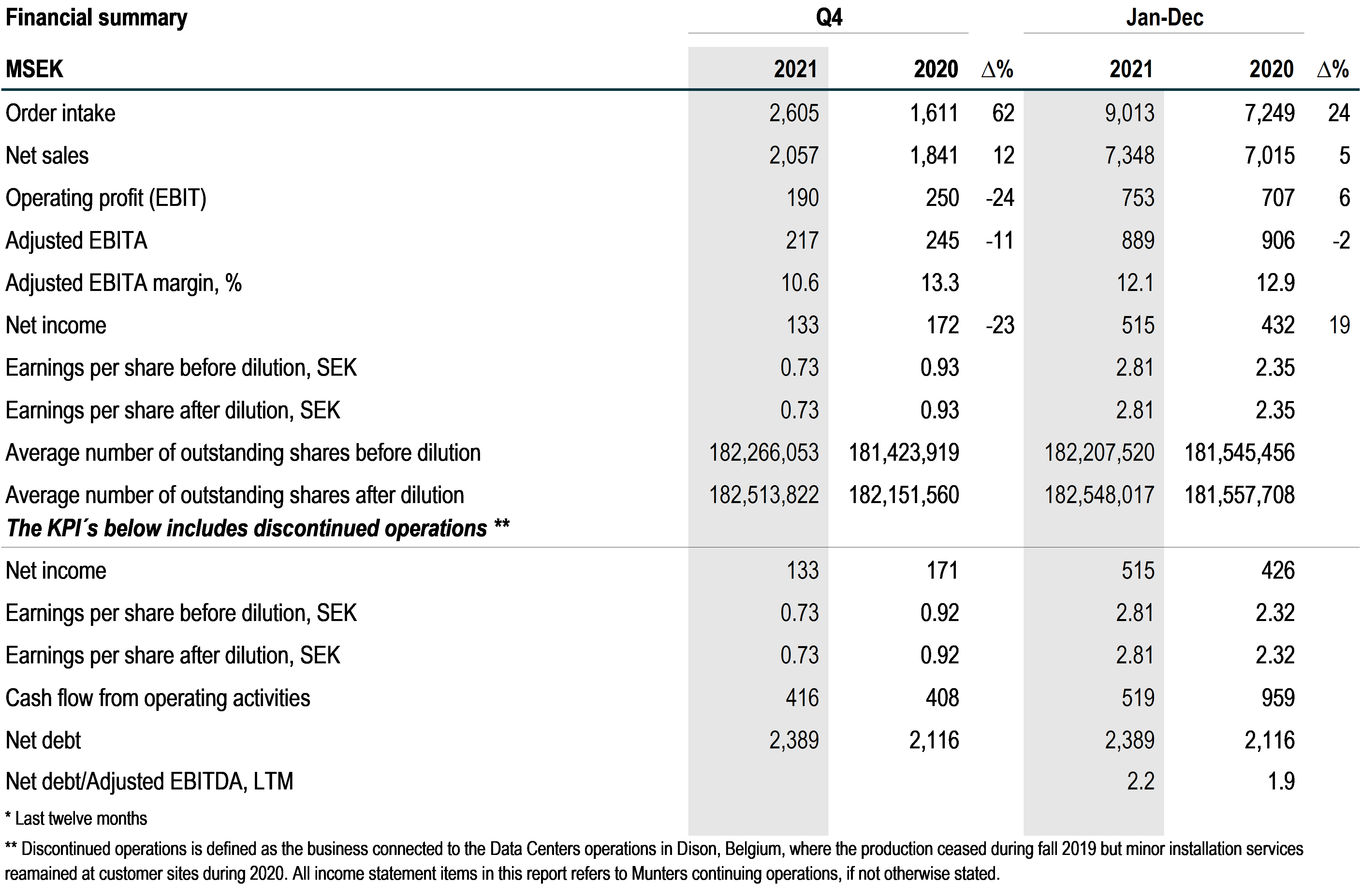

- Order intake was very strong and increased by +62%, a currency adjusted increase of +59%, and net sales increased +12%, currency adjusted +10%, mainly driven by strong growth in business area AirTech, in Battery and Data Centers as well as Services. Business area FoodTech had good growth in Americas and EMEA.

- The adjusted EBITA-margin was 10.6% (13.3), negatively impacted by supply chain constraints, higher raw material prices and freight costs and the time lag of our own price increases. Also, a changed business mix in Airtech, production inefficiencies in a facility in the US as well as lower FoodTech volumes in China had an impact.

- Leverage (net debt/adjusted EBITDA, LTM*) was 2.2x, in line with the level at the end of September 2021. In the quarter sustainability targets were linked to the primary financing facilities (SLL).

- Net debt as of year-end amounted to MSEK 2,389 compared to MSEK 2,536 at the end of September 2021.

January - December 2021

- Strong demand with impact of supply chain constraints from the second quarter and forward.

- Order intake increased by +24%, currency adjusted +30% and net sales increased +5%, currency adjusted +10%, mainly driven by strong growth in Battery, Data Centers and Services in business area AirTech. FoodTech experienced growth in Americas and EMEA, offset by a weak swine market in China.

- The adjusted EBITA-margin was 12.1% (12.9), negatively impacted by supply chain constraints, higher raw material prices and freight costs as well as the time lag of the impact of our own price increases and production inefficiencies in a facility in the US in the fourth quarter. The AirTech margin was positively impacted by increased net sales, high utilization rates and efficiency improvements while the FoodTech margin was negatively impacted by lower volumes in China.

- Leverage (net debt/adjusted EBITDA, LTM*) was 2.2x, slightly higher than 1.9x per end of December 2020.

- Net debt as of December 31 amounted to MSEK 2,389 compared to MSEK 2,116 at year-end 2020. In the second quarter a 5-year re-financing was secured enabling execution of the long-term strategy.

Events after the period close:

- The Board of Directors propose a dividend of 0.85 (0.70) SEK per share for 2021 totaling a dividend of MSEK 157 (129).

- Munters announced the acquisition of EDPAC, an Ireland-based manufacturer of data center cooling equipment and air handling systems for a purchase price of MEUR 29.

- FoodTech, through MTech Systems, signed a contract to deliver its Software-as-a-Service (SaaS) solution.

CEO Comments

Record high order intake driven by demand for battery-driven vehicles and increased data traffic

The strong order intake in the AirTech business area continued and was record high in the quarter and for the full year 2021. Demand for our energy-efficient climate solutions is especially high in the battery and data center segments. The robust order intake is driven by the transition to battery-powered vehicles and increased data traffic. To further take advantage of the strong market trends, we recently acquired Edpac, an Irish data center equipment manufacturer. Through Edpac, we get access to well-established production capacity and a prioritized customer base in the attractive, quickly growing European data center market. Last year decisions were also taken to expand capacity in order to meet demand, for example within the battery segment by building a new facility in the Czech Republic. These initiatives strengthen our solid base for continued growth in prioritized market segments. In the FoodTech business area, development was good in Americas in the quarter and in 2021, while demand in the swine segment in China was weak during the second half of the year. The swine segment in China was negatively impacted by overcapacity and the African Swine Fever. Through focus on value-based selling and product rationalization as well as investments in digital customer solutions, FoodTech strengthen its leading position and creates a stable foundation for profitable growth. This year, MTech Systems, a Munters company within FoodTech, also signed an important contract to deliver its SaaS solution. It is a recognition of our strategy to grow Digital Solutions.

Supply chain challenges impacted profitability

As expected, we were affected in the quarter by continued challenges in the supply chain. In the quarter, we saw positive effects from our price increases and continued to raise prices to mitigate higher raw material prices and freight costs. As earlier communicated, most of the price increases will take effect during 2022 due to longer lead times. The difficulties with anticipating timing of deliveries of input goods and components, combined with effects of the pandemic, has especially affected a production unit in the industrial sub-segment in the US. This, along with a changed business mix in AirTech with more larger projects and lower volumes for FoodTech in China, affected profitability negatively. We continue to anticipate that the challenges in the supply chain will remain throughout the first half of 2022.

Investments create further growth opportunities

Munters’ has a clear growth strategy and targets markets characterized by solid longer-term growth. These markets are to a large extent driven by the strong sustainability and digitalization trends. Our leading climate solutions are often mission-critical for our customers’ success and meet their needs to improve efficiency and reduce energy consumption. By our investments in selected competences and digitalization of our ways of working, we create further opportunities to grow and increase profitability.

Significant progress in 2021

In 2021, we strengthened our leading market position and exceeded our customers’ expectations in several areas. I would like to highlight three areas where we have made particular progress. One is sustainability where we set the target to have zero net emissions from our operations by 2030. Secondly, the continued strong cash generation in 2021 and the third one our employees’ ability to manage the challenges in the supply chain. In conclusion, I would like to thank all the employees who, with professionalism and perseverance, contributed to Munters’ success in 2021.

Klas Forsström, CEO and President

Information about the webcast

You are welcome to join a webcast or telephone conference today, at 9:00am CEST, when President and CEO Klas Forsström, together with Group Vice President and CFO Annette Kumlien, will present the report.

Webcast:

https://tv.streamfabriken.com/munters-q4-2021

Dial-in number for the telephone conference:

SE: +46 8 50558350

UK: +44 3333009262

US: +1 6319131422

This interim report, presentation material and a link to the webcast will be available on https://www.munters.com/en/investor-relations/

Contact person:

Ann-Sofi Jönsson, Head of Investor Relations and Enterprise Risk Management

Phone: +46 (0)730 251 005

Email: ann-sofi.jonsson@munters.com

This information is information that Munters Group AB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 07.30am CEST on February 4, 2022.

About Munters Group

Munters is a global leader in energy efficient air treatment and climate solutions. Using innovative technologies, Munters creates the perfect climate for customers in a wide range of industries. Munters has been defining the future of air treatment since 1955. Today, around 3,300 employees carry out manufacturing and sales in more than 30 countries. Munters Group AB reported annual net sales of more than SEK 7 billion in 2020 and is listed on Nasdaq Stockholm. For more information, please visit www.munters.com.